3 Closed-End Funds Bought In March 2022

RomoloTavani/iStock by using Getty Photographs

This article was initially published on April 1st, 2022, to users of the CEF/ETF Income Laboratory.

March made available traders a bit of a reprieve from the volatility and reasonably constant losses professional in January and February. Of study course, individuals months made available buyers considerably far better chances, also, as is generally the circumstance when volatility in the market place kicks up. I think that there are continue to a whole lot of eye-catching values in the shut-close fund space—certainly, a lot better valuations than we noticed at the end of 2021.

That getting explained, I purchase positions just about every month, no issue the recent environment. The only matter that adjustments is how intense or conservative I am when building buys. This lets for my revenue to mature thirty day period just after month. I hit the current market with a lot of purchasing in January. I then allowed February for cash to create up, which meant I was not as aggressive as I really should have been in hindsight.

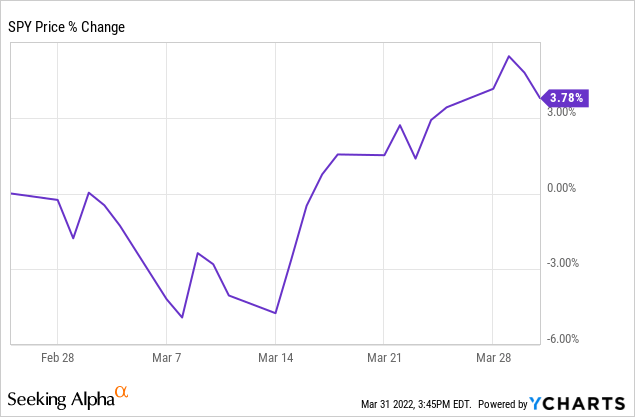

I did the exact matter in March, making it possible for cash to create up in my portfolio. I essentially only started building buys in the latter 50 percent of the thirty day period. So considerably, with the electrical power of hindsight when yet again, it also turned out to be incorrect timing as I ought to have been more aggressive in the very first half of the month. On the lookout at the S&P 500 SPDR Believe in ETF (SPY), we can see the market place really commenced its rebound proper in close proximity to mid-thirty day period.

YCharts

With that, listed here are the three resources I procured in March to include to my escalating income. All of these resources I had beforehand, I was only incorporating to my positions.

BlackRock Wellness Sciences Trust (BME)

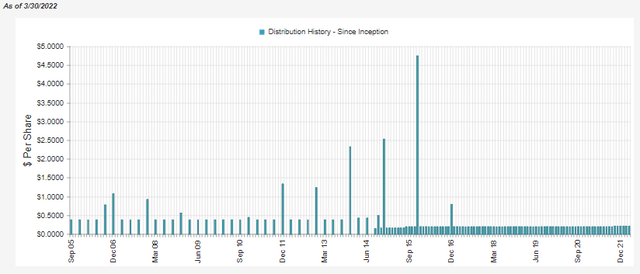

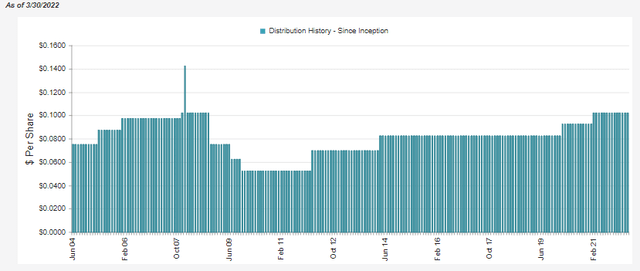

The initially I additional to was BME. This is a noteworthy fund in that it is only one of a handful of resources with an inception pre-2008, and they have not at any time reduce their distributions to shareholders. They experienced paid out a quarterly distribution but then switched to a every month payout in 2014. When they designed that switch, it was proper close to when they really upped their payout far too.

In reality, we have somewhat recently obtained another boost from the fund. It is really hard to tell from the chart under, but it went from a regular monthly distribution of $.20 to $.2130 starting up in October 2021.

BME Distribution Heritage (CEFConnect)

This was a welcomed boost as they paid the $.20 amount given that 2015. At this time, it operates out to a distribution generate of 5.70%, and on a NAV basis, it is effective out to a pretty sustainable 5.62%.

I deal with BME considerably often, but in this article are some of the essentials for those people unfamiliar.

BME’s investment objective is “total return through a blend of earnings, latest gains and prolonged-time period capital appreciation.” They will try to realize this by a quite simple investment plan – “below ordinary market place conditions, at least 80% of its assets in equity securities of companies engaged in the health sciences and related industries and equity derivatives with publicity to the wellbeing sciences business.” They will then put into action a covered get in touch with crafting strategy towards positions in their portfolio. Writing against unique positions can deliver possibility top quality that improves what they can spend out to buyers.

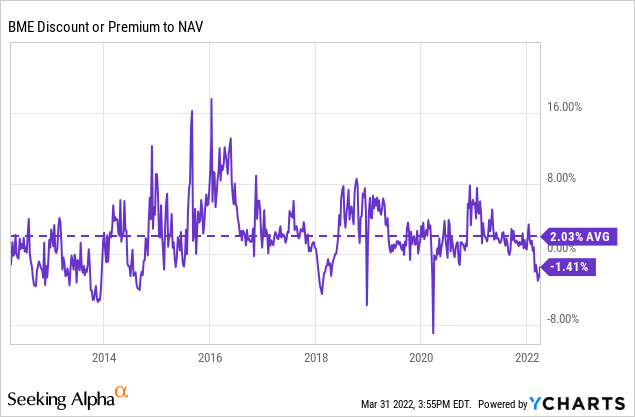

The fund has almost never traded at a price reduction to the NAV in the previous 10 years. It has not traded at extreme rates but at a a lot more reliable premium. Having said that, that has improved in March, which spurred me to acquire gain of the opportunity.

YCharts

Calamos Strategic Complete Return Fund (CSQ)

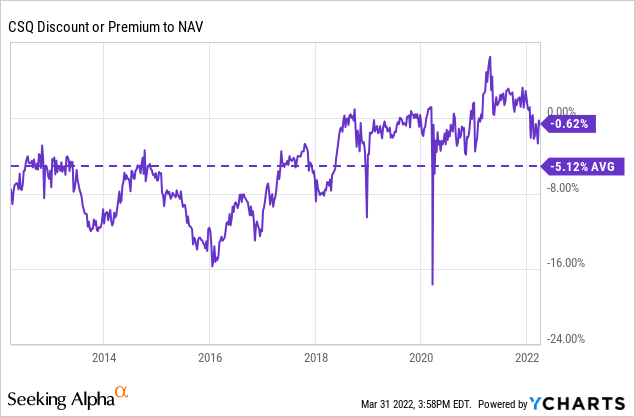

CSQ has been similar to BME in that it does not typically trade at a discount for very long periods of time, at the very least in a lot more modern yrs. Former to about 2018, the fund had traded at a low cost alternatively persistently.

YCharts

Nonetheless, this is a placement that I think about a far more core part of my CEF portfolio. I’ve wanted to insert to this fund for a though now. The fund touched price reduction degrees, and the total declines in the broader markets have opened up an attractive option. That is even even though its premium hasn’t been fairly as consistent as BME around the very last ten years.

This is another fund I cover regularly, so my additional repeated viewers are most likely common with this name.

CSQ’s goal is to request “full return through a mixture of cash appreciation and present-day income.” They endeavor to obtain this simply just by “investing in a diversified portfolio of equities, convertible securities and substantial generate company bonds.”

The fund can spend exactly where they see the ideal prospects may well be. That is element of the appeal of lively administration, the versatility to adapt to distinct cases. Although it need to be observed that the fund will have “at minimum 50% in equity securities.”

The fund has experienced a sequence of distribution cuts in 2008/09, so they are unable to rather declare the title of currently being as steady of a payer. Even so, a single constant factor is the frequency, as they’ve paid a month to month distribution due to the fact their inception. At this time, the payout is the same $.1025 a month that they experienced pre-2008.

CSQ Distribution Heritage (CEFConnect)

The fund’s distribution yield works out to 6.99%. Thanks to just about buying and selling at parity with its NAV, the NAV yield comes out to a comparable 6.95% amount. The fund will depend noticeably on funds gains, and they have professional some appreciable losses this 12 months. That will be some thing to check out or look at likely forward on the other hand, I don’t imagine the NAV fee is in the hazard zone nevertheless.

EcoFin Sustainable and Social Impact Expression Fund (TEAF)

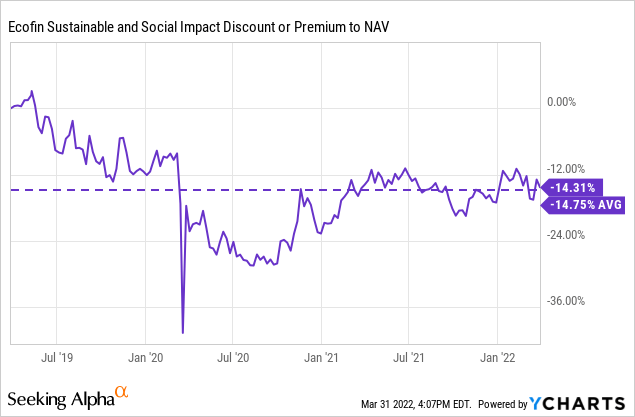

TEAF is a more uncommon fund. As opposed to BME and CSQ that I purchased, this fund trades at a sizeable price reduction and has primarily since it has introduced.

Tortoise launched TEAF with the target of “desirable complete return prospective with emphasis on current revenue and uncorrelated assets.” Also, “entry to differentiated direct investments in critical assets” and “investments in tangible, long-lived property and products and services.”

TEAF is also focusing on a “favourable social and financial effect.” Fundamentally, they are an ESG-focused fund with an emphasis on infrastructure. A significant portion of their holdings is connected with vitality-associated infrastructure with a qualifications in the power place. While it is exclusive from the other Tortoise funds, it also carries a major exposure to industries outside the house of the energy field.

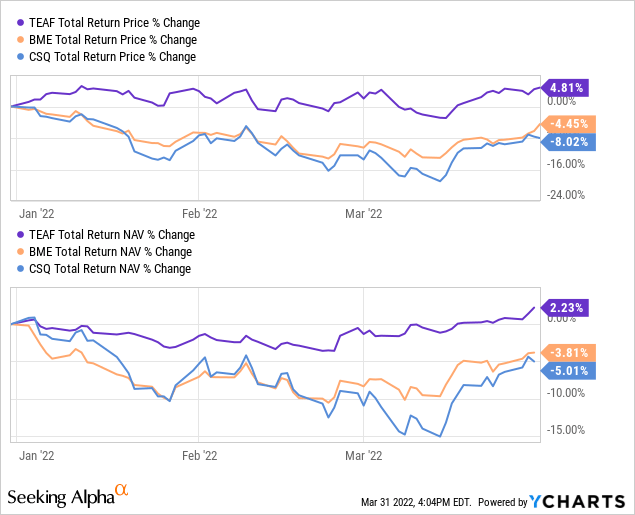

Also, contrary to the other two cash I have purchased this thirty day period, it shows positive outcomes YTD in conditions of functionality. Very little as well magnificent, but favourable in this first quarter of 2022 appears worthy of noting.

YCharts

One of the motives for this is that it has exposure to electricity and utility investments. Vitality is major the sector for the year by a major volume. In actuality, the only other sector that is good for the calendar year as measured by the SPDR ETFs. That is the utility sector that is hanging on as a defensive participate in.

The fund is one of a kind due to the fact it has significant exposure to private investments and a tilt in direction of renewable electricity. This could also be why the fund’s lower price has been so regular. Personal investments can be riskier and more durable to value. Therefore, traders sometimes leave a greater margin of safety. In addition, the fund has executed improperly given that it launched, holding traders away.

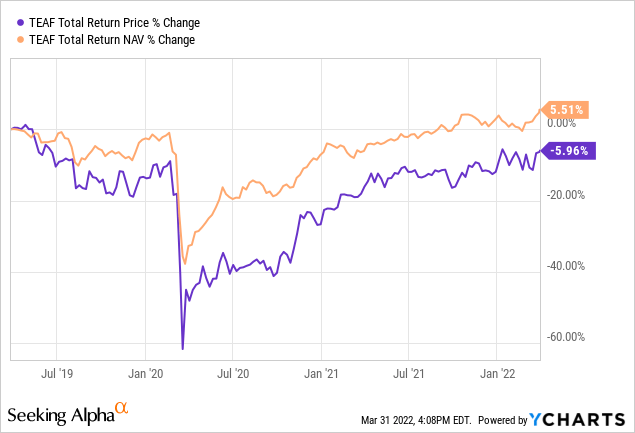

YCharts

Doing poorly considering the fact that start is surely not a little something worthy of bragging about. Given the underlying investments, it looks that strength experienced the most major negative effects on the fund in 2020. On the other hand, it also is dependent on when you purchased this name. My initially batch was in September 2021. My second is now this previous thirty day period as the discount remains desirable, in my viewpoint. Presented this, my share value return only is up practically 40%, not counting any of the distributions.

I also think that the underlying investments are quite persuasive, at minimum the concept of them. Over-all, this is a tiny posture in my portfolio, so it will never make or break me in the very long run. Down below is a chart of the effectiveness of TEAF given that its inception.

YCharts

Conclusion

March completed up on a optimistic note for traders. However, it continue to seems there is a significant quantity of uncertainty going ahead. Some caution from buyers seems merited. In hindsight, I should really have been far more intense in buying in February and early March. That remaining said, owing to these uncertainties likely ahead, we could get a great deal far more opportunities. In the end, I’m generating new purchases each and every month and increasing my earnings – and that is definitely my key aim!